We balance an opportunistic approach with an intensive focus on reducing downside risk and protecting capital through detailed due diligence, in-depth property analysis and deliberate portfolio diversification.

Investment Strategy

We Exploit Middle Market

Inefficiencies Where We can

Create the Greatest Value

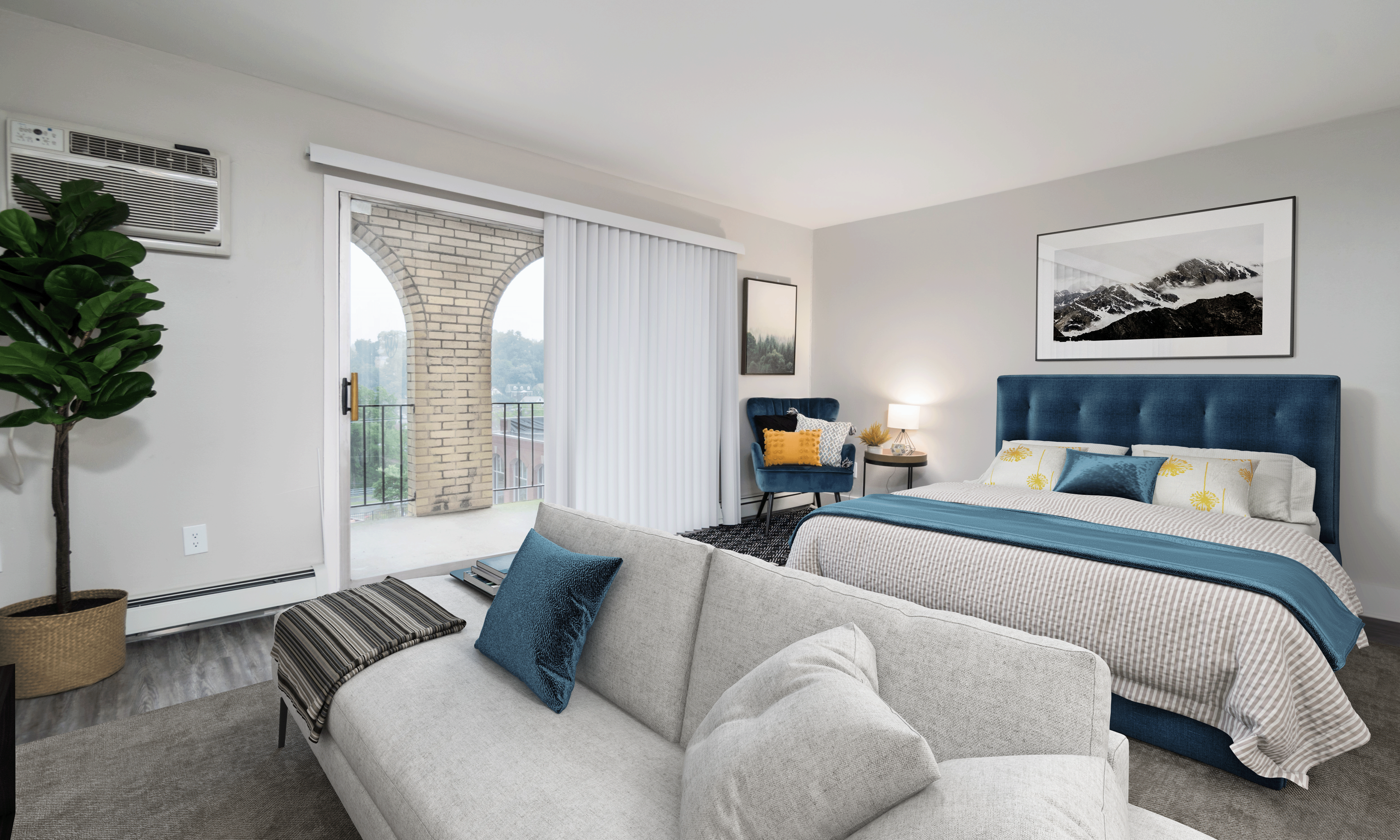

ABR drives returns for our investors by seeking to acquire properties below replacement cost, securing effective management, repositioning and upgrading assets throughout our hold period, and exiting to strategic buyers who derive the most value from ownership.

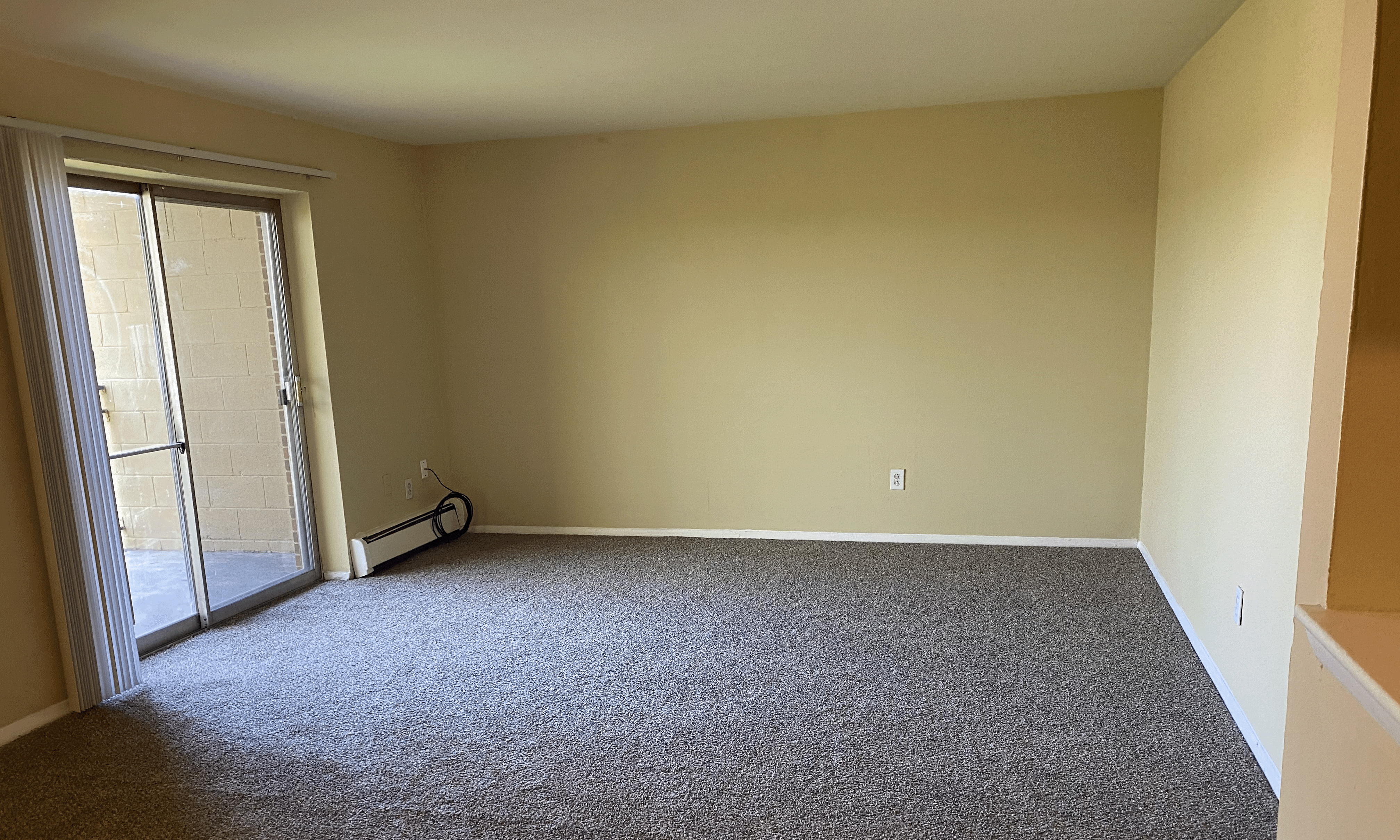

We look for assets that are well-located but have been mismanaged or lack the necessary capital to remain competitive relative to their peers. We generally avoid assets that present binary risks.

Investment Sectors

Our National Platform Comprises Diversified Assets

ABR’s fifty years of experience includes investments in virtually every property sector. Given this market intelligence and durable economic trends, the firm’s current focus centers on housing, including senior, student and conventional rental properties, industrial, such as flex, small bay and transportation related properties, healthcare including medical office buildings, and special situations that leverage the firm’s experience and investment network.